Introduction to Credit Card Debt Relief

Credit card debt relief strategies are essential as the statistics related to credit card debt are alarming and continue to escalate annually. Presently, around 1% of households may encounter bankruptcy, while over 90% of disposable income for Americans is consumed by repaying debts.

The Weight of Credit Card Debt

Americans, in total, spend upwards of $1 trillion each year on credit card purchases. This figure may not seem concerning at first, but the real issue emerges when individuals carry balances, resulting in approximately $500 billion in unpaid debt.

Consequently, the average family finds itself with debts ranging from $5,000 to $8,000, with around $1,000 spent each year just on interest payments. This average obscures the fact that many people are grappling with significantly larger debts.

Diminishing Savings Culture

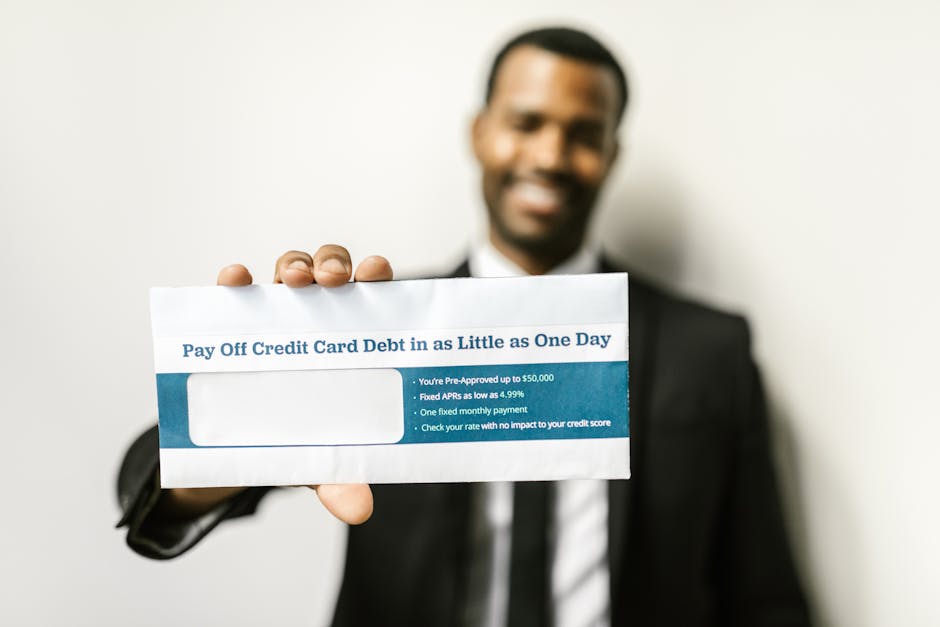

Every day, numerous Americans receive enticing credit card offers in their mailboxes, indicating the immense financial resources allocated to the credit card industry.

The effects of debt extend beyond individual finances; they have repercussions on the economy and public services. Bankruptcy places a strain on the judicial system, while government resources are diverted to debt counseling services, highlighting the widespread nature of debt.

Additionally, individuals burdened with high levels of debt often curtail their spending, which can hinder overall economic growth.

Causes of Rising Debt

Debt has become a normalized aspect of modern society. In earlier times, even small amounts of debt were viewed negatively. People would save up for their purchases, only spending when they had enough funds. A comparison of consumer debt statistics from fifty years ago reveals significantly lower levels than what we observe today. The reasons for this transformation are varied and hotly debated, but the ability to save appears to be diminishing, especially in Western societies. Outside of retirement savings, few individuals adequately prepare for future expenses, prompting banks to offer higher interest rates to attract deposits into savings accounts. In a society that increasingly values instant gratification, the importance of patience and long-term financial planning seems to be fading.

Conclusion

While it may appear that overspending is the primary driver of debt, numerous factors contribute to financial hardships. Events such as job loss or unexpected medical emergencies can force individuals to rely on credit cards for essential needs, leading to a quick escalation of debt. Recognizing the true cost of maintaining credit card balances is crucial for individuals to understand the detrimental effects of compounding interest on their financial well-being.