Introduction to Student Loan Consolidation

If you’re juggling multiple student loans, considering student loan consolidation might be a wise choice. This approach simplifies your finances by reducing the number of payments you need to manage, often leading to lower monthly costs compared to the traditional repayment plan spanning a decade. Programs like the Federal Family Education Loan Program (FFEL) enable banks, credit unions, and other lenders to offer consolidation loans specifically aimed at combining educational debts. Additionally, the William D. Ford Federal Direct Loan Program provides options for federal student loan consolidation. By consolidating your loans, you can streamline your payments and potentially lower your interest rates, making it a key strategy in managing your finances effectively.

Benefits of Student Loan Consolidation

Lower monthly payments can ease financial pressure and improve cash flow.

Simplified payments mean you only have to remember one due date, reducing the risk of missed payments.

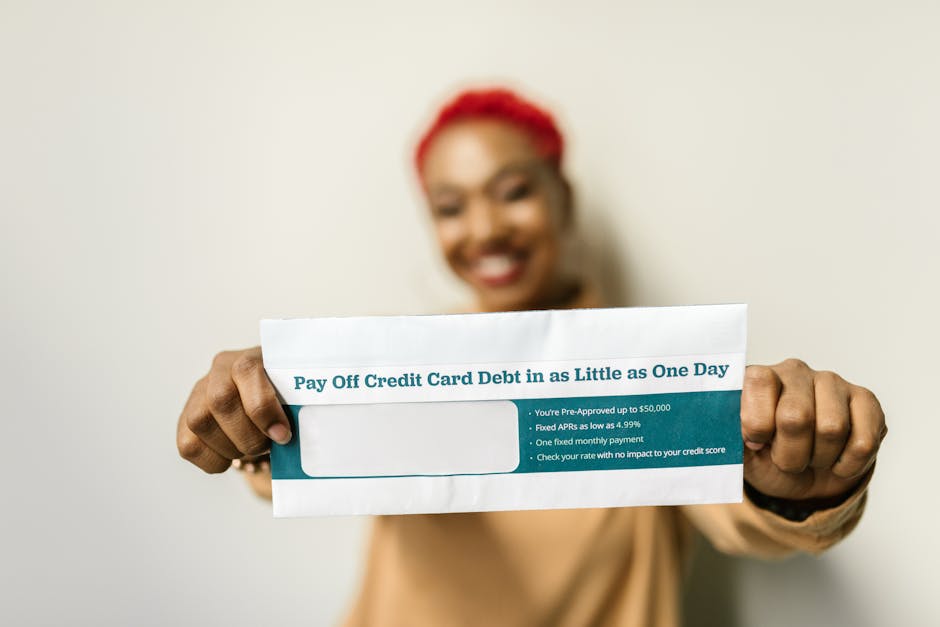

Steps to Choose a Debt Consolidation Program

When considering an unsecured debt consolidation program, the first step is to consult with a financial expert. This individual, often referred to as a debt relief advisor or settlement specialist, can provide valuable insights and answer your inquiries regarding the loan process. Remember, the goal of a debt consolidation loan is to aid you, not just benefit your creditors. The company you engage with will manage negotiations on your behalf, as they are seasoned professionals in finance and debt management. While this program may not be suitable for everyone, it is worth investigating various unsecured debt consolidation options available through phone consultations or online research.

Conclusion

By understanding how to effectively manage your student loans through consolidation, you can take significant strides towards financial stability. Utilizing these strategies can lead to a more organized approach to your finances, making it easier to navigate your educational debt.