Understanding Debt Consolidation

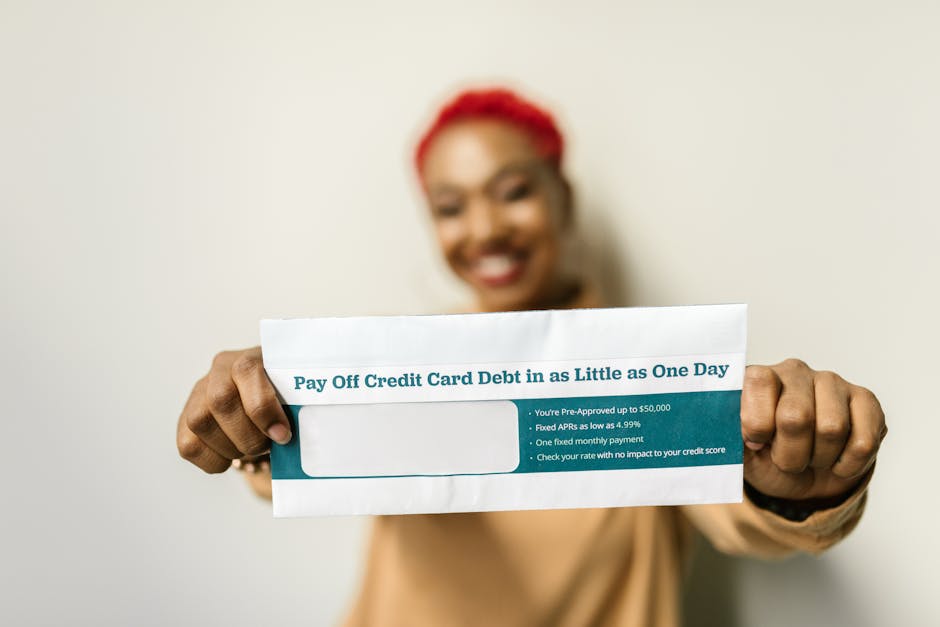

Debt consolidation is a strategic method for individuals seeking to alleviate their financial burdens. If you’re feeling overwhelmed by late payments and constant calls from creditors, considering debt consolidation might be the solution you need. This approach can significantly alter your financial situation in a relatively short timeframe, customized to your specific debt circumstances. By unifying your debts, you can take control of your financial destiny while fostering a balanced lifestyle. It’s essential to grasp the benefits and processes of debt consolidation for anyone aiming for long-term financial health. Comprehending the mechanics of debt consolidation empowers you to make educated choices regarding your financial wellbeing, ultimately leading to financial relief.

Advantages of Debt Consolidation

Many individuals wrongly assume that once their debts become unmanageable, drastic measures like bankruptcy or foreclosure are their only options.

In reality, avoiding foreclosure is often possible, and repossession is not a foregone conclusion. Creditors generally prefer to work with you on a debt consolidation strategy that allows them to recover their funds while you preserve a healthy credit score.

Bankruptcy and repossession can leave lasting scars on your financial history; thus, it is wise to explore debt consolidation as a viable alternative before considering more severe actions.

Collaborating with Debt Consolidation Firms

Handling debt consolidation on your own can be daunting, especially if your credit history leaves much to be desired. Fortunately, many debt consolidation agencies are equipped to assist those facing financial challenges. These organizations will assess your credit profile and outstanding debts to create a feasible repayment strategy. They often engage with creditors to negotiate lower interest rates or even reduce the total amount owed, which can significantly lessen your monthly financial burdens. Partnering with a debt consolidation agency can streamline the process and provide you with professional support, enhancing your chances of achieving financial relief.

Conclusion

Confronting significant debt can be intimidating, yet debt consolidation offers a structured method for managing your financial obligations. Even if you feel that your debt is overwhelming, numerous organizations are available to help you tackle this issue. Keep in mind that your credit score plays a crucial role in your financial prospects, and every payment you make brings you closer to enhancing it. Don’t hesitate to reach out to a debt consolidation service; taking this initiative reflects your dedication to financial responsibility and can pave the way for a more secure financial future.